Trade Receivables Debit or Credit

IFRS 9 Financial Instruments requires companies to measure impairment of financial assets including trade receivables using the expected credit loss model. Transaction 6 Trade Receivables Account Debit Credit To Sales AC INR 4 lakh from FAC 304 at Shiv Nadar University.

Writing Off An Account Under The Allowance Method Accountingcoach

Ad Shop thousands of high-quality on-demand online courses.

. It is classified in the Balance Sheet as Current Asset since the entity has legal. Net Trade Receivables Total Credit Sales - Sales Discounts - Sales Returns - Sales Allowances - Collections. As mentioned earlier it can be seen that Trade Receivables and Other Receivables are categorized as Current Assets in.

Ending balance beginning balance - Debit BDE and Credit Allowance. Accrual accounting records credits and debits at the time. DDebit to bad debt expense of 1000.

ACredit to allowance for doubtful accounts of 1100. Trade Receivables 6000 sundry debtors 9000 bills receivable 15000. Join learners like you already enrolled.

There are a broad range of potential. To put it simply Trade receivables arise when the entity sells goods and services to its customers on credit basis. For cash accounting businesses record credits and debits when transactions occur and money passes hands.

Back into Current Year BDE. Trade receivables are the sum of money your customers owe you for buying goods and services on credit. Yes in addition to credit balances you may also encounter debit balances.

Debit Trade receivables Credit Opening balance 175000 Transaction 5b 53550 from ECON 62 at Henry J. As per the golden rules of accounting debit means assets and credit means liabilities. CCredit to allowance for doubtful accounts of 1200.

Calculate Ending Balance in allowance. Account receivables represent transaction exposure in the form of cash inflow s See more. BDebit to bad debt expense of 900.

Ending beginning. Allowance for Doubtful Accounts. Trade Receivables and Other Receivables in the Balance Sheet.

Put simply a debit balance is an amount that is owed to you by a vendor. Example Trade Receivables. The original entry will be in Ingrids Sales Day Book which lists all credit sales chronologically.

These amounts are a significant component to. Calculate trade receivables from the below balance sheet. Account receivables are the cash inflows that the creditor will receive based on the credit period given to the customers as per the prevailing market trend.

Total credit sales including the 6450 will be posted from the Sales Day Book to the debit of.

Trade Receivables And Revenue Acca Global

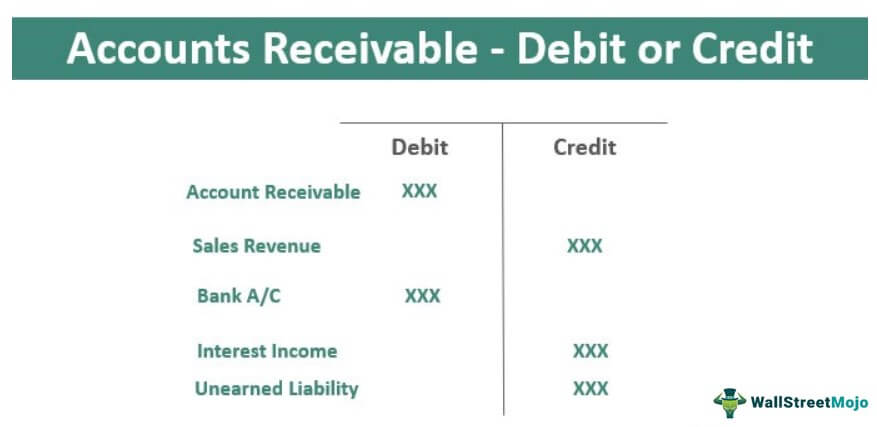

Accounts Receivable Debit Or Credit Top Examples Treatment In Ifrs

No comments for "Trade Receivables Debit or Credit"

Post a Comment